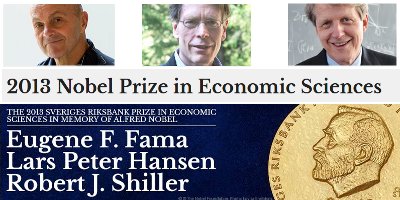

The 2013 Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel was awarded jointly to Eugene F. Fama, Lars Peter Hansen and Robert J. Shiller "for their empirical analysis of asset prices".

The noble prize in economics was given to three US based economists - Eugene Fama, Lars Peter Hansen and Robert J. shiller for their “Empirical analysis of asset prices”.

The noble prize in economics was given to three US based economists - Eugene Fama, Lars Peter Hansen and Robert J. shiller for their “Empirical analysis of asset prices”.

History of Nobel Prize in Economic Sciences:

The prize in Economic Sciences starts from the Year of 1969 while the prize in other categories started from the Year of 1901, in Memory of Alfred Nobel and is awarded by the Royal Swedish Academy of Sciences, Stockholm, Sweden, according to the same principles as for the Nobel Prizes in other fields.

In 1968, Sweden’s Central Bank Sveriges Riksbank established the Prize in Economic Sciences and the Prize is based on a donation received by the Nobel Foundation in 1968 from Sveriges Riksbank on the occasion of the Bank's 300th anniversary. The first Prize in Economic Sciences was awarded to Ragnar Frisch and Jan Tinbergen in 1969 and till 2013 74 laureates received this prestigious award.

The Three Laureates of 2013:

Eugene F. Fama

Eugene F. Fama

Born on 1939 in Boston,USA

Citizenship- USA

Academic Qualification – In 1964 Got Ph.D from University of Chicago,IL,USA

His Theory of Efficient Market Hypothesis-

He is called he Father of market hypothesis for his prediction of how stock prices would change in short run and Market prices react surprisingly fast to new pieces of information, he suggested, and stock price movements are unpredictable, following a “random walk” pattern.

Fama, is also of the view that financial bubbles does not exist and asserted that recessions are a largely unexplainable fixture of capitalism that should be allowed to take their course. His research has examined how external factors such as insider trading and government regulation can distort the workings of financial markets.

Fama has recently specialized in producing models that show the way stock markets and other asset markets work.

Books & Journals-

- “My life in finance”. Annual Review of Financial Economics, 2011

- “Efficient capital markets: a review of theory and empirical work”.Journal of Finance, 1970

- “Efficient capital markets II”. Journal of Finance,1991.

Lars Peter Hansen

Lars Peter Hansen

Born on 1952, USA

Academic Qualification- In 1978 got his Ph.D from University of Minnesota, Minneapolis, MN, USA.

The Theory of Asset Pricing on Empirical Data-

Mr Hansen, a macroeconomist at the University of Chicago, also shared the prize for his development of statistical methods to test theories of asset pricing on empirical data. He is most famous for developing the generalized method of moments estimation back in 1982. He deployed his innovation to analyze how asset pricing works which has since become a workhorse of econometric analysis.

In 1982 Hansen presented a statistical theory – called the Generalized Method of Moments – then used it to test whether historical share prices were consistent with the best known asset-pricing model at the time. He found the methods being used must be rejected because they failed to explain share movements. As a result, Hansen's work helped confirm Shiller's preliminary findings on bubbles and inspired new research.

Books & Journals-

Journals;-

- Ghysels, E., Hall, A., and Hansen L. P. (2002). “Interview with Lars Peter Hansen”.

- Hansen, L. P. (2008). “Generalized method of moments estimation” in The New Palgrave Dictionary of Economics.

- Hansen, L. P. (1982). “Large Sample Properties of Generalized Method of Moments Estimators”. Econometrica,

- Examining Macroeconomic Models Through the Lens of Asset Pricing

- Challenges in Identifying and Measuring Systemic Risk

- Risk Pricing Over Alternative Investment Horizons

- Under identification

- Three Types of Ambiguity

- Stochastic Compounding and Uncertain Valuation

Books

- Advances on economics and econometrics

- Handbook on econometrics

- Rational expectations econometrics

- Robustness

Robert J. Shiller , Yale University, New Haven, CT, USA

Robert J. Shiller , Yale University, New Haven, CT, USA

Born 1946 in Detroit, MI, USA.

Academic Qualification- Got his Ph.D. 1972 from Massachusetts Institute of Technology (MIT), Boston, MA, USA.

His Theory of Housing Bubbles-

Mr Shiller, based at Yale University, showed that what is true at very short horizons is not necessarily true over longer periods. Seminal work by him found that while asset prices are meant to be an aggregate of expected changes in pay-offs dividends vary much less than stock prices. Interestingly, this makes future stock price movements easier to predict. When the price-dividend ratio is high prices tend to fall. Not only does this relationship hold for stocks, but for other assets such as bonds too.

His research showed that investors can be irrational and that assets from stocks to housing can develop into bubbles.He concluded that rational models of the stock market, in which stock prices reflect rational expectations of future payouts, are in error. This clever combination of logic, statistics, and data implies that stock markets are, instead, prone to irrational exuberance.”

Shiller, is one of the few economists who can claim to have foreseen both the bursting of the dotcom bubble and the US housing crash. His prescient book Irrational Exuberance was first published in 2000, and he followed it up with a second edition in 2005, which took the then unfashionable view that US housing looked dangerously overvalued and he warned for many years about a housing bubble in the U.S. and which came to be true when the world economy faced a worst financial crisis after the Great Depression.”

BOOKS & JOURNALS-

- Latest book: Finance and the Good Society, Princeton, 2012

- Financial Markets Lectures Now with Subtitles in Over 50 Languages

- "The Yale Tradition in Macroeconomics" (For Yale Economics Reunion)

- Disclosure of Outside Activities

- S&P/Case-Shiller Indices Methods

- With Randall Kroszner, Reforming U.S. Financial Markets, MIT Press, 2011

- "Stimulus and Regulation," Testimony before UN General Assembly, 2nd Committee, 2010

- The Squam Lake Report, Princeton, 2010

- Animal Spirits (with George Akerlof), Princeton, 2009

- Subprime Solution, Princeton, 2008

- Information Site for Subprime Solution

- Stockmarket Confidence Indexes

- Standard & Poor’s/Case–Shiller Home Price Indices

- Behavioral Finance

- Behavioral Macroeconomics

- Information Site for The New Financial Order

- Information Site for Irrational Exuberance

- “Finance in the 21st Century” Column for Project Syndicate

- “Economic View” Column for New York Times

- Online Video “Financial Markets” Newer (2011) Version of Course via Open Yale

FURHTER READINGS-

- www.nobelprize.com

- www.wikipedia.com

- The guardian.Com

- The Times of India-Article on Nobel Prize on Economics

- The Times Magazine- Article on Nobel Prize on Economic Sciences 2013

- Blog of Mr. Fama, Mr. Shiller & Mr.Hansen

- Official website of Chicago University